Shares and shareholding structure

- 2-1

Organisational details

ORLEN’S EQUITY and shareholding structure

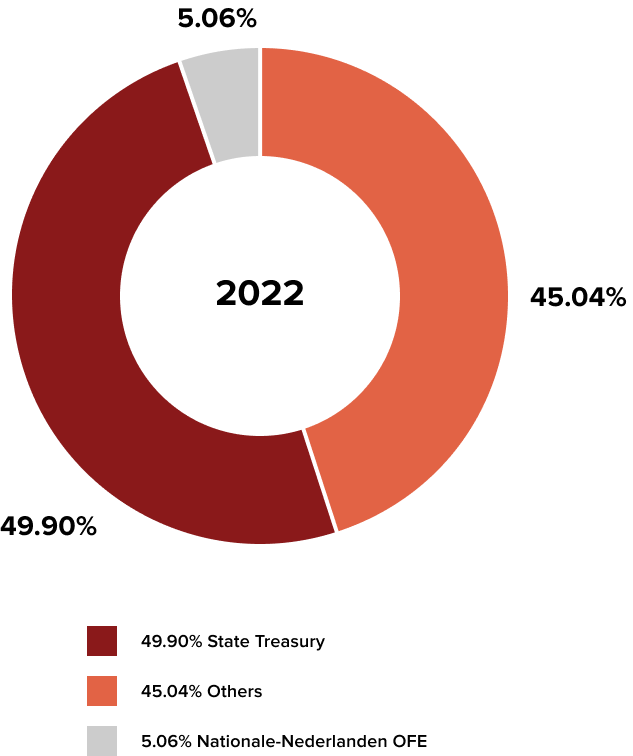

ORLEN shareholding structure1

- As at December 31st 2022, the share capital of ORLEN was divided into 1,160,942,049 ordinary bearer shares with a par value of PLN 1.25 per share. ORLEN shares are freely transferable.

- The ORLEN Management Board has no knowledge of any agreements which would results in future changes of holdings of Company shares.

- In 2022, the ORLEN Group did not operate any employee stock option scheme.

- As at December 31st 2022, members of the ORLEN Management Board did not hold any Company shares.

- Roman Kusz, a member of the ORLEN Supervisory Board, held 925 Company shares ss at December 31st 2022.

1ORLEN shareholding structure as at the date of authorisation of this Report.

In 2022, ORLEN merged with Grupa LOTOS and PGNiG. Both mergers were executed in compliance with Article 492.1.1 of the Commercial Companies Code. This process involved transferring all assets, including rights and obligations (assets and liabilities) of Grupa LOTOS and PGNiG (the acquired companies) to ORLEN, the acquirer. Simultaneously, the Company's share capital was increased through the issuance of merger shares, which were delivered to the shareholders of Grupa LOTOS and PGNiG, respectively.

The Company's Extraordinary General Meeting held on July 21st 2022 gave its approval for the merger with LOTOS Group S.A. in Gdańsk, along with the issuance of 198,738,864 Series E bearer shares (numbered from E000000001 to E-198738864). This led to an increase in the Company's share capital to PLN 783,059,906.25.

Respective amendments to the Company's Articles of Association were registered in the Business Register of the National Court Register on August 1st 2022 by the District Court for Łódź-Śrómieście in Łódź, 20th Commercial Division of the National Court Register, and on August 10th 2022 the Management Board of the Warsaw Stock Exchange decided to admit and introduce the Series E shares issued by ORLEN to trading on the WSE main market. On August 12th 2022, the Central Securities Depository of Poland registered these shares under ISIN code PLPKN0000018.

Following the issuance of the Series E, the State Treasury, represented by the Minister of State Assets, announced an increase in its ownership of ORLEN shares, following the merger of ORLEN with Grupa LOTOS, the increase in share capital, and the amendments to the ORLEN’s Articles of Association adopted by the Extraordinary General Meeting on July 21st 2022. Prior to the change, the State Treasury held 117,710,196 ORLEN shares, which represented 27.52% of the Company's share capital and carried entitled to 117,710,196 votes at the General Meeting, or 27.52% of the total voting rights. Following the merger, the State Treasury came to hold 223,414,424 ORLEN shares, representing 35.66% of the Company's share capital and conferring the right to 223,414,424 votes, or 35.66% of total voting rights in the Company.

On October 6th 2022, the State Treasury submitted a notification of a decrease in its share of the total voting rights in the Company from 35.66% to 31.14%. Prior to the change, the State Treasury held 223,414,424 ORLEN shares, which represented 35.66% of the Company's share capital and carried 223,414,424 votes at the General Meeting, representing 35.66% of the total voting rights in the Company. Following the changes, the State Treasury held 195,092,264 ORLEN shares, or 31.14% of the Company's share capital and carrying 195,092,264 votes at the Company's General Meeting, representing 31.14% of the total voting rights in the Company.

Subsequently, on September 28th 2022, the Extraordinary General Meeting of the Company passed a resolution to merge the Company with Polskie Górnictwo Naftowe i Gazownictwo Spółka Akcyjna of Warsaw, KRS 0000059492, and to increase the share capital to PLN 1,451,177,561.25, through the issuance of 534,494,124 Series F bearer shares (numbered from F-000000001 to F-534494124). On November 2nd 2022, the District Court for Łódź-Śródmieście in Łódź, 20th Commercial Division of the National Court Register, registered the merger of ORLEN and Polskie Górnictwo Naftowe i Gazownictwo S.A. as well as the share capital increase and the relevant amendments to the ORLEN’s Articles of Association. In connection with the merger, ORLEN's share capital was increased from PLN 783,059,906.25 to PLN 1,451,177,561.25.

On November 15th 2022, the Management Board of the Warsaw Stock Exchange resolved to admit and introduce ORLEN's Series F shares to trading on the main market of the WSE, effective as of November 18th 2022. The Central Securities Depository of Poland registered Series F shares on November 18th 2022, under ISIN code PLPKN0000018.

With the registration of the Company's share capital increase, the total number of shares outstanding is now 1,160,942,049, each with a par value of PLN 1.25. The total number of voting rights attached to all Company shares is 1,160,942,049.

Following the changes described above, shareholders notified the following changes in their holdings of Company shares:

1. On November 7th 2022, the State Treasury, a shareholder of ORLEN, announced an increase in its percentage of total voting rights in the Company. This information was subsequently corrected by the shareholder on November 29th 2022. The shareholder notified a change in its holding of the ORLEN shares from 31.14% to 49.90%.

Prior to the change, the State Treasury held 195,092,264 ORLEN shares, representing 31.14% of the Company's share capital and conferring 195,092,264 votes at the General Meeting, i.e. 31.14% of the total voting rights.

Currently, the State Treasury holds 579,310,079 ORLEN shares, representing 49.90% of the Company's share capital and conferring the right to 579,310,079 votes, or 49.90% of total voting rights in the Company.

2. On November 7th 2022, Aviva Otwarty Fundusz Emerytalny Aviva Santander notified of a decrease in its percentage of total voting rights in ORLEN, from 5.43% to 3.99%.

Prior to the change, Aviva OFE held 34,023,504 ORLEN shares, representing 5.43% of the Company's share capital and conferring the right to 34,023,504 votes, or 5.43% of total voting rights in the Company. As of the disclosure date, Aviva OFE reported holding 46,274,140 shares in ORLEN, which represented 3.99% of the Company's share capital and carried 46,274,140 votes at the General Meeting, i.e. 3.99% of the total voting rights in the Company.

ORLEN’s shareholding structure as at January 1st 2022 and December 31st 2022.

ORLEN shareholding structure as at the date of authorisation of Management Board report on the operations of ORLEN Group and PKN ORLEN S.A. for the year 2022

ORLEN on the stock exchange

In 2022, the blue-chip WIG20 index fell by 20.95% (y/y), while the all-cap WIG index was down by 17.08% (y/y). The price of ORLEN’s stock decreased by 13.59% in that period. The absolute annual rate of return on ORLEN shares (i.e., taking into account dividend distribution and dividend reinvested in the stock) was -9.52% in PLN. Following the acquisition of the LOTOS and PGNiG companies and the issue of merger shares, 1,160,942,049 ORLEN shares were traded on the stock exchange. Their value as at the end of the year was PLN 74,578.92 million.

Key facts and figures on ORLEN shares.

Performance of ORLEN shares on the Warsaw Stock Exchange; 1999–2022.

Source: In-house analysis based on the Warsaw Stock Exchange data.

ORLEN, WIG20 and WIG PALIWA quotations on the WSE in 202210.

10 Percentage change in ORLEN and WIG 20 quotations relative to December 30th 2021.

Source: In-house analysis based on the Warsaw Stock Exchange data.

Dividend policy

The new ORLEN Group is larger, stronger and fully diversified. In accordance with the updated Strategy to 2030, published in February 2023, the Group has greater capacity for investment and sharing profits with the shareholders. The new dividend policy provides for annual dividend distributions at 40% of the adjusted free cash flow, but no less than the guaranteed dividend of PLN 4.00 per share for 2022, to be increased progressively each year by PLN 0.15 to PLN 5.20 in 2030.

The recommended dividend for 2022 is the highest on record, at PLN 5.50 per share.

Restrictions on transferability of shares

The Company’s Articles of Association do not impose any restrictions on the transferability of ORLEN shares. However, such restrictions may be stipulated by generally applicable laws including, without limitation, the Act on State Property Management and the Act on Control of Certain Investments.

Exercising voting rights and shareholders’ special control powers

Detailed rules for the exercise of special control powers and voting rights are laid down in ORLEN’s Articles of Association. According to the provisions of the Articles of Association, one ORLEN share confers one voting right at the Company’s General Meeting. The voting rights of shareholders have been capped in the Articles of Association so that none of them may exercise more than 10% of total voting rights existing at the Company as at the date when the General Meeting is held. The cap on voting rights does not apply to the State Treasury and the depositary bank which has issued, on the basis of an agreement with the Company, depositary receipts in respect of Company shares (if this entity exercises voting rights conferred by Company shares). For the purposes of the Articles of Association, the exercise of voting rights by a subsidiary is deemed the exercise of such voting rights by its parent as defined in the laws referred to the Articles of Association, whereas the total number of voting rights held by a shareholder is the sum of the voting rights attached to the shares held by the shareholder and the voting rights which the hareholder would receive as a result of conversion of the depositary receipts held by the shareholder into shares.

Shareholders whose voting rights are aggregated or reduced are jointly referred to as a “Shareholder Grouping”. The aggregation of voting rights consists in adding up all voting rights held by individual shareholders comprising a Grouping. The reduction of voting rights consists in decreasing the total number of voting rights held at the General Meeting by shareholders comprising a Grouping. Detailed rules of such aggregation and reduction are specified in the Articles of Association. Shareholders forming a Shareholder Grouping may not exercise more than 10% of total voting rights existing at the Company as at the date when the General Meeting is held. If the aggregated number of shares registered at the General Meeting by shareholders forming a Shareholder Grouping exceeds 10% of total voting rights at the Company, the voting rights resulting from the number of shares held are subject to reduction, the rules of which have been specified in detail in the Articles of Association. The cap on voting rights described above does not apply to subsidiaries of the State Treasury.

The State Treasury, represented by the entity authorised to exercise the rights attached to the shares held by the State Treasury, has the right to appoint and remove one member of the Supervisory Board. In addition, one member of the ORLEN Management Board is appointed by the entity authorised to exercise the rights attached to the shares held by the State Treasury as long as the State Treasury holds at least one share in the Company; such member of the ORLEN Management Board is removed by the Supervisory Board.

Additionally, in accordance with the Articles of Association, as long as the State Treasury is entitled to appoint a member of the Supervisory Board, a resolution granting consent for transactions involving any sale or encumbrance of shares in the following companies:

- Naftoport Sp. z o.o.,

- Inowrocławskie Kopalnie Soli S.A.,

- as well as the company to be established to operate the pipeline transport of liquid fuels, will require a vote in favour of its adoption by the Supervisory Board member appointed by the State Treasury.

With the merger processes that occurred in the Company in 2022 and the corresponding amendments to its Articles of Association effected following the merger with Polskie Górnictwo Naftowe i Gazownictwo S.A., ORLEN is now mandated to undertake tasks that contribute to the energy security of Poland as part of its core business activities. The amendments made to the Articles of Association as a result of the merger processes in 2022 have granted new powers to the State Treasury as the Company’s shareholder. These powers are now clearly defined in the Articles of Association.

It is important to note that, in line with amended Articles of Association, the State Treasury, can specifically:

- Has the right to demand that the Company's Management Board provide detailed information concerning the tasks executed to guarantee national energy security.

- Has the right to obtain information from the Company's Management Board, no later than two months following the conclusion of the Annual General Meeting, pertaining to:

implementation by the Company of any strategic investment projects or its involvement in any investment projects which are necessary to ensure Poland’s energy security,- entry by the operator or owner of a distribution system or interconnector into an obligational relationship with a foreign entity for, or in connection with, the planning, review, construction, expansion or disposal of a transmission network, distribution network, interconnector or direct line as defined in the Energy Law where the present value of such infrastructure or, for new projects, including projects being planned, its estimated value exceeds the PLN equivalent of EUR 500,000,

- entry by the operator or owner of a storage facility into an obligational relationship with a foreign entity for, or in connection with, the development, review, construction, expansion or disposal of storage facilities as defined in the Energy Law where the present value of such infrastructure or, for new projects, including projects being planned, its estimated value exceeds the PLN equivalent of EUR 500,000,

- entry by the owner of a generation or cogeneration unit into an obligational relationship with a foreign entity for, or in connection with, the development, review, construction, expansion or disposal of a generation or cogeneration unit as defined in the Energy Law where the present value of such infrastructure or, for new projects, including projects being planned, its estimated value exceeds the PLN equivalent of EUR 500,000, or

- entry into an obligational relationship with a foreign entity in relation to, or in connection with, hydrocarbon exploration, appraisal or production, within the meaning of the Polish Geological and Mining Law, if the value of the obligational relationship exceeds the PLN equivalent of EUR 5,000,000 - with the proviso that items a) - e) above shall not apply to information on credit agreements, maintenance services, including overhauls, geophysical, drilling, and well services, as well as services or deliveries related to the performance of such agreements or activities, and item 5) shall not apply to information on activities of a foreign subsidiary in connection with the execution of contracts and agreements related to the administration of the subsidiary’s organisation in the ordinary course of its business, including employment contracts, use of assets where the related liabilities do not exceed EUR 5,000,000, or general and administrative expenses.

- In its capacity as a shareholder of ORLEN, the State Treasury is also entitled to receive detailed information on decisions made by General Meetings of ORLEN’s Subsidiaries or Associates, within 21 days after conclusion of such meetings, if the matters discussed pertain to those listed in the ORLEN Articles of Association and have implications for Poland's energy security. However, this does not include information on credit facility agreements, maintenance services, including overhauls, geophysical, drilling or well services or projects, or any related services or deliveries. Additionally, this does not include information on any foreign Subsidiary’s activities in connection with the execution of contracts and agreements related to the administration of the subsidiary’s organisation in the ordinary course of its business, including employment contracts, use of assets where the related liabilities do not exceed EUR 5,000,000, or general and administrative expenses.

- In addition, the entity authorised to exercise rights attached to the shares held by the State Treasury and the minister competent for energy matters are entitled to receive from the Company economic and financial analyses of the Company and its related companies acting as a distribution system operator or a storage system operator.

- Notwithstanding the above, the energy minister, if requested by the Management Board of the Company and having received the opinion of the entity authorised to exercise rights attached to the shares held by the State Treasury shares, has the power to grant approval for:

- amendment of material provisions of existing contracts for natural gas imports to Poland and execution of new such contracts,

- implementation by the Company of a strategic investment project or the Company’s participation in an investment project which may permanently or temporarily impair it economic efficiency but which is necessary to carry out a national energy security task in connection with:

- ensuring continuity of natural gas supplies to customers and maintaining the required emergency natural gas stocks,

- ensuring safe operation of gas networks,

- balancing the gas market and managing the operations and capacity of energy facilities and equipment connected to the national gas grid,

- natural gas production.

- As a shareholder, the State Treasury, in compliance with the Company's Articles of Association, acknowledges the guidance of the Management Board of the Company in regard to appointing or dismissing the Company's representatives on the Management Board and Supervisory Board of System Gazociągów Tranzytowych EuRoPol Gaz S.A.Special rights vested in the State Treasury as the Company’s shareholder may also result from generally applicable provisions of law, i.e.:

- the Act on Special Rights Vested in the Minister Competent for Energy and their Exercise in Certain Capital Companies or Groups Conducting Business Activities in the Electricity, Crude Oil and Gas Fuel Sectors, dated March 18th 2010,

- the Act on Control of Certain Investments, dated of July 24th 2015,

- the Act on State Property Management, dated December 16th 2016.

Ratings

According to rating agencies, ORLEN's acquisition processes (mergers with Grupa LOTOS and PGNiG) conducted in 2022, which consolidate the Polish energy sector, will have a positive impact on increasing the Group's degree of business diversification and the stability of its cash flows. As a result of the acquisitions, Moody's Investors Service has raised ORLEN's rating twice (in August and October 2022) from Baa2 to A3. In November 2022, Fitch Ratings also increased ORLEN’s rating from BBB- to BBB+. The assigned ratings are the highest in the history of the Company. For a description of the ratings assigned to the bonds and notes issued by the ORLEN Group, see Section 6.2.3 of this Report.

Read also:

Short-cuts:

ORLEN Group 2022 Integrated Report

You can also download the report in PDF format

.jpg)